BUSINESS

Mitch T Kloter Unlicensed Transport Business: Facts, Context, and What You Should Know

Introduction

If you’ve ever searched the phrase mitch t kloter unlicensed transport business, chances are you weren’t casually browsing. Most people don’t stumble into queries like this—they arrive with questions, concerns, or a need for clarity. Maybe you’re a consumer trying to verify legitimacy. Maybe you’re a researcher, journalist, or business professional looking to understand how unlicensed transport operations surface and why they matter. Or maybe you’re simply trying to separate fact, speculation, and misunderstanding in an industry that’s often opaque.

Transportation is one of those sectors where trust is everything. We put our safety, time, cargo, and money into the hands of operators we may never meet again. Licensing exists for a reason: it establishes accountability, safety standards, and legal oversight. When questions arise around licensing status—whether about a specific operator or a broader business model—it’s worth slowing down and examining the issue carefully rather than jumping to conclusions.

In this guide, we’ll break down what the term mitch t kloter unlicensed transport business typically signals in search intent, how unlicensed transport operations are identified, why these discussions arise, and what practical steps individuals and businesses can take to protect themselves. This article is not about accusations; it’s about understanding systems, risks, verification methods, and compliance realities—the kind of grounded, real-world insight that helps readers make informed decisions.

By the end, you’ll have a clear framework for evaluating transport businesses, understanding licensing requirements, spotting red flags, and navigating this topic with confidence rather than confusion.

Topic Explanation

To understand what people usually mean when they search mitch t kloter unlicensed transport business, it helps to first unpack how licensing works in the transport industry—and why the word “unlicensed” carries so much weight.

A licensed transport business is one that has met regulatory requirements set by local, state, or federal authorities. These requirements often include vehicle inspections, insurance coverage, driver qualifications, safety audits, and ongoing compliance reporting. Licensing isn’t just a formality; it’s a signal that an operator has passed multiple checkpoints designed to protect the public.

An “unlicensed” transport business, on the other hand, is typically defined as one operating without proper authorization for the services it provides. This doesn’t always mean malicious intent. In many real-world cases, businesses fall into gray areas—operating under the wrong classification, misunderstanding jurisdictional rules, or failing to renew permits on time. Think of it like driving with an expired license: still the same driver, still the same car, but legally non-compliant.

When a specific name becomes associated with searches like this, it often reflects public curiosity rather than proven wrongdoing. Online discussions, reviews, complaints, or regulatory inquiries can cause people to look for context. As a seasoned blogger or researcher, the responsible approach is to treat the phrase as a case-study-style keyword, not a verdict.

The key takeaway here is simple: searching this term usually means people want to understand how unlicensed transport operations are identified, what risks they pose, and how to verify legitimacy, not to consume gossip or unverified claims.

Benefits & Use Cases

You might wonder: why does understanding a phrase like mitch t kloter unlicensed transport business matter if you’re not directly involved in transportation? The answer is that the implications ripple far beyond one name or one operation.

For consumers, the benefit is protection. Knowing how licensing works allows you to verify whether a transport provider—rideshare-adjacent services, logistics operators, private carriers—is operating legally. This reduces exposure to safety risks, insurance gaps, and service disputes that are far harder to resolve when a business isn’t properly registered.

For business owners and contractors, understanding this topic helps you avoid costly partnerships. Many companies unknowingly subcontract or collaborate with transport providers who lack proper credentials. When something goes wrong, liability doesn’t stop at the driver—it can travel up the chain to whoever hired them.

Journalists, writers, and SEO professionals also benefit from this knowledge. Writing about sensitive topics requires balance. Knowing how to frame discussions around unlicensed transport activity without making claims ensures content remains credible, rankable, and legally safe.

Common real-world scenarios include:

- A customer researching a transport provider after a delayed or disputed service

- A company vetting logistics partners before signing contracts

- A regulator or compliance officer analyzing industry trends

- A blogger or publisher covering consumer safety topics responsibly

In all these cases, the goal isn’t accusation—it’s informed decision-making. Understanding the broader context empowers people to ask the right questions and take the right next steps.

Step-by-Step Guide

If you’re trying to evaluate concerns implied by searches like mitch t kloter unlicensed transport business, a structured, methodical approach works best. Guesswork and assumptions only muddy the waters.

Step one is define the service being offered. Licensing requirements vary dramatically depending on whether a business provides passenger transport, freight hauling, courier services, or private logistics. Many misunderstandings happen because people apply the wrong regulatory standard to the wrong category.

Step two is check jurisdictional requirements. Transport licensing is often layered. A business may be compliant locally but not federally, or vice versa. Understanding which authority governs the service is critical before drawing conclusions.

Step three involves verifying public records. Most legitimate transport businesses appear in licensing databases, business registries, or regulatory filings. Absence doesn’t always equal non-compliance, but it does warrant further inquiry.

Step four is review insurance and safety disclosures. Licensed operators typically carry specific insurance types and publish safety or compliance information, either publicly or upon request.

Finally, step five is evaluate patterns, not noise. One complaint or online post doesn’t define a business. Consistent reports, regulatory notices, or documented enforcement actions carry far more weight than isolated claims.

This step-by-step approach mirrors how compliance professionals and investigators actually work—slow, deliberate, evidence-based.

Tools, Comparisons & Recommendations

When researching transport business legitimacy, tools matter—but knowing which tools to trust matters even more.

Free tools like public business registries and government license lookup portals are often the first stop. They provide baseline information: registration status, permit numbers, and expiration dates. Their limitation is depth; they rarely tell the whole story.

Paid compliance platforms, on the other hand, aggregate licensing, insurance, and enforcement data across jurisdictions. These tools are commonly used by logistics firms and enterprise clients because they save time and reduce risk. The downside is cost and complexity—overkill for casual consumers.

A practical recommendation is to combine sources. Start with free public records, then cross-check with industry databases or direct documentation requests. Legitimate operators rarely object to transparency.

The biggest expert insight here is simple: no single tool gives full certainty. Credible conclusions come from cross-verification, not one screenshot or search result.

Common Mistakes & Fixes

One of the most common mistakes people make when encountering searches like mitch t kloter unlicensed transport business is assuming the keyword itself implies guilt. In reality, search behavior reflects curiosity, not court rulings.

Another frequent error is misunderstanding regulatory scope. A business might appear “unlicensed” under one authority while being fully compliant under another. Fixing this requires understanding jurisdiction, not speculation.

People also rely too heavily on online commentary. Reviews, forums, and social posts are useful signals—but they’re not evidence. The fix is simple: prioritize primary sources and official records.

Finally, many readers stop researching too early. Compliance is nuanced. Taking the extra step to verify details often changes the entire narrative.

Conclusion

The phrase mitch t kloter unlicensed transport business isn’t just a keyword—it’s a doorway into a much larger conversation about trust, regulation, and responsibility in the transport industry. Handled carelessly, topics like this can misinform. Handled correctly, they educate and empower.

By understanding how licensing works, how concerns arise, and how legitimacy is verified, you put yourself on solid ground. Whether you’re a consumer, a business owner, or a content creator, clarity beats assumption every time.

If you found this breakdown useful, consider exploring related compliance guides, sharing this with colleagues, or leaving thoughtful questions that push the discussion forward responsibly.

FAQs

It typically refers to operating transport services without the required permits for that specific service or jurisdiction.

No. Search terms reflect interest or concern, not verified conclusions.

Check official registries, request documentation, and confirm insurance coverage.

No. Requirements vary widely by region and service type.

Because transport regulations are complex and frequently updated.

BUSINESS

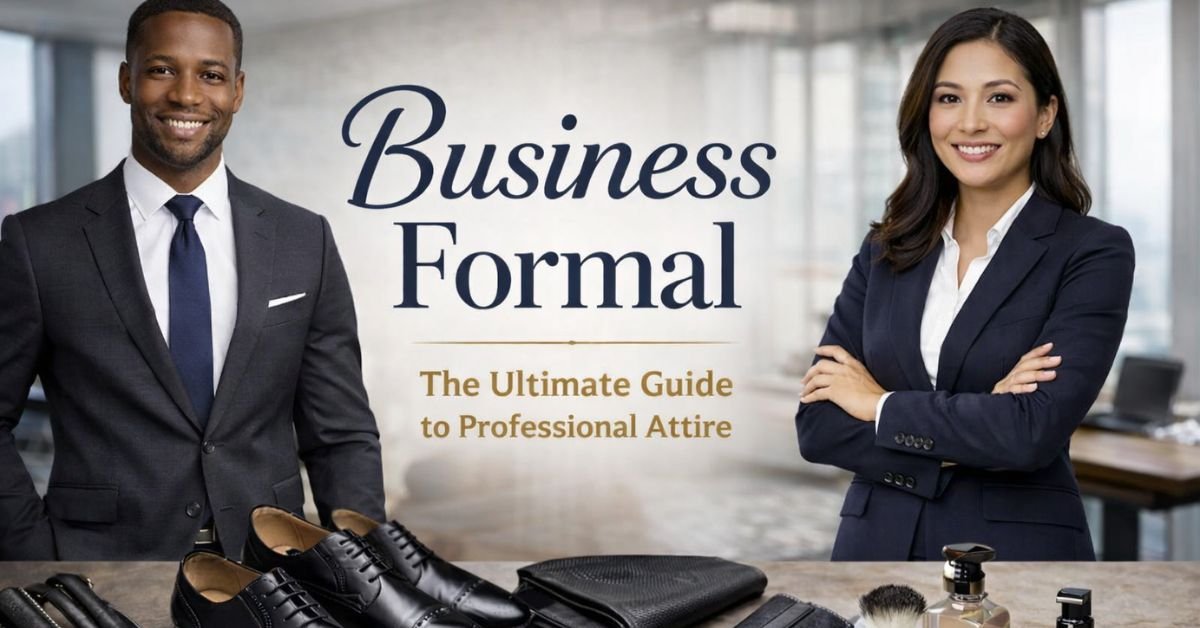

Business Formal: The Complete, Real-World Guide to Dressing With Authority, Confidence, and Credibility

Introduction: Why Business Formal Still Matters (More Than You Think)

Let’s start with a truth most people won’t say out loud: business formal intimidates people.

Not because it’s complicated — but because the rules feel invisible. One wrong blazer cut, the wrong shoe polish, a slightly casual fabric, and suddenly you’re the only person in the room who feels underdressed, overdressed, or simply out of place.

Business formal isn’t just about clothes. It’s about first impressions, trust, authority, and perceived competence — all formed in seconds before you’ve spoken a word.

In high-stakes environments like executive meetings, legal settings, corporate finance, international business, or formal interviews, business formal still carries weight. It signals seriousness. It says, “I respect this room, this moment, and the people in it.”

This guide will walk you through business formal from the ground up — no fashion fluff, no outdated rules, no confusing jargon. You’ll learn what business formal really means today, how it differs by context, how to dress correctly step by step, what mistakes quietly sabotage credibility, and how to make business formal work for you instead of against you.

Whether you’re entering corporate life, leveling up your leadership presence, or simply tired of guessing — this is your definitive, practical guide.

What Is Business Formal? A Clear, Beginner-Friendly Explanation

Business formal is the most conservative and polished professional dress code. It prioritizes structure, restraint, quality, and consistency over personal expression.

Think of business formal like the “grammar” of professional clothing. Just as proper grammar helps your ideas land clearly, business formal ensures your appearance doesn’t distract from your message.

At its core, business formal communicates three things:

- Professional competence

- Respect for institutional norms

- Reliability under pressure

For men, this traditionally means a tailored suit, formal dress shirt, tie, leather dress shoes, and restrained accessories. For women, it typically involves a structured suit (pantsuit or skirt suit), conservative blouse, closed-toe shoes, and minimal jewelry.

But here’s the modern nuance: business formal isn’t frozen in time. Fabrics have evolved, cuts are cleaner, and inclusivity has expanded the acceptable silhouettes — while still maintaining polish.

A useful analogy:

Business formal is like a luxury hotel lobby. It’s elegant, intentional, and calm. Nothing flashy. Nothing sloppy. Everything belongs.

Unlike business casual (which allows interpretation), business formal is about reducing uncertainty. When people see you, they shouldn’t wonder if your outfit is appropriate — it should simply register as “correct.”

Business Formal vs. Other Dress Codes (Why Confusion Happens)

One reason people struggle with business formal is because it’s often confused with other professional dress codes. Let’s clear that up.

Business formal sits at the top of the formality ladder:

- Casual – comfort-first, personal expression

- Business casual – relaxed professionalism

- Smart business / business professional – polished but flexible

- Business formal – structured, traditional, conservative

Business casual might allow knit blazers, loafers without socks, patterned dresses, or relaxed fabrics, business formal does not.

If business casual says “I’m competent and approachable,” business formal says “I’m accountable, authoritative, and here for serious outcomes.”

This distinction matters in:

- Legal environments

- Executive leadership roles

- Investor meetings

- Government or diplomatic settings

- High-level interviews

Wearing business casual where business formal is expected doesn’t make you look modern — it makes you look unaware of the room.

Benefits and Real-World Use Cases of Business Formal

Why Business Formal Still Works Psychologically

Multiple studies in workplace psychology confirm that formal attire increases perceived authority, trustworthiness, and attention to detail.

When you dress business formal:

- People interrupt you less

- Your ideas are taken more seriously

- You’re assumed to be senior or experienced

- You’re judged on substance, not appearance

This isn’t about vanity — it’s about removing friction from communication.

Who Business Formal Is Best For

Business formal is especially valuable for:

- Executives and senior managers

- Lawyers, bankers, auditors, consultants

- Job seekers in conservative industries

- Entrepreneurs pitching investors

- Professionals working internationally

It’s also ideal when:

- You’re new and need instant credibility

- Stakes are high and impressions matter

- You’re representing an organization, not just yourself

Real-Life Scenarios Where Business Formal Wins

- A junior professional wearing a sharp business formal suit commands more respect in meetings than a casually dressed senior who looks disengaged.

- In interviews, candidates dressed business formal are often remembered more clearly and perceived as more prepared.

- During negotiations, business formal subtly signals seriousness and stability.

Business formal doesn’t guarantee success — but it removes doubt.

Step-by-Step Guide: How to Dress Business Formal Correctly

Step 1: Start With the Right Suit

The suit is the foundation of business formal.

For men:

- Two-piece or three-piece suit

- Solid colors: navy, charcoal, dark gray, black

- Structured shoulders, clean lines

- Minimal pattern (if any)

For women:

- Matching blazer and trousers or skirt

- Neutral tones: black, navy, gray, beige

- Tailored fit — not tight, not oversized

- Structured fabric that holds shape

Fit matters more than brand. A mid-range suit tailored properly beats an expensive ill-fitting one every time.

Step 2: Choose a Professional Shirt or Blouse

Shirts should be crisp, clean, and understated.

- White, ivory, or light blue are safest

- Avoid sheer fabrics

- Avoid loud prints or trendy cuts

- Proper sleeve and collar structure

The goal is clarity, not creativity.

Step 3: Shoes Make or Break Business Formal

Shoes are where credibility often quietly fails.

For men:

- Leather Oxford or Derby shoes

- Black or dark brown

- Polished and well-maintained

For women:

- Closed-toe heels or flats

- Neutral colors

- Stable heel height

- Clean lines, no embellishments

Scuffed shoes undermine everything else.

Step 4: Accessories Should Whisper, Not Shout

Business formal accessories are intentional and minimal.

- Conservative belts

- Classic watches

- Minimal jewelry

- Structured bags

If someone remembers your accessories more than your conversation, they were too much.

Step 5: Grooming Is Non-Negotiable

Business formal extends beyond clothing.

- Clean, styled hair

- Neutral makeup

- Trimmed facial hair

- Light or no fragrance

Presentation is part of professionalism.

Tools, Comparisons, and Smart Recommendations

Free vs. Paid Styling Help

Free tools:

- Office dress code guides

- Brand lookbooks

- Workplace observation

Paid options:

- Tailoring services

- Professional stylists

- Capsule wardrobe consultations

Ready-to-Wear vs. Custom Tailoring

Ready-to-wear:

- Faster

- Cheaper

- Limited precision

Tailored:

- Perfect fit

- Higher upfront cost

- Long-term confidence

For business formal, tailoring is often the smartest investment.

Expert Tip

Own fewer pieces, but make them exceptional. Business formal rewards consistency over variety.

Common Business Formal Mistakes (and How to Fix Them)

Mistake 1: Confusing Business Casual With Business Formal

Fix: When in doubt, go more formal. You can always remove a tie or blazer — you can’t add one later.

Mistake 2: Poor Fit

Fix: Budget for tailoring. Even minor adjustments change everything.

Mistake 3: Over-Accessorizing

Fix: Remove one accessory before leaving the house.

Mistake 4: Ignoring Shoes and Grooming

Fix: Treat shoes and grooming as part of your outfit, not an afterthought.

Mistake 5: Trend-Chasing

Fix: Business formal favors timelessness. Trends date quickly and signal instability.

The Modern Evolution of Business Formal

Business formal today is more inclusive, flexible, and realistic — but the core principles remain.

Modern business formal:

- Allows diverse body types

- Supports cultural variations

- Embraces comfort through better fabrics

- Focuses on intention over rigidity

What hasn’t changed is respect for the environment you’re in.

Conclusion: Business Formal Is a Strategic Tool, Not a Costume

Business formal isn’t about pretending to be someone you’re not.

It’s about showing up prepared, polished, and aligned with the moment.

When done right, business formal disappears — leaving only your confidence, competence, and clarity.

Master it once, and you’ll never second-guess your presence again.

If you’re building a professional wardrobe, refining your leadership image, or stepping into higher-stakes rooms — business formal is still one of the most powerful tools you can use.

FAQs

Business formal attire includes tailored suits, professional shirts or blouses, conservative shoes, and minimal accessories designed for formal professional settings.

Yes. Business formal remains essential in leadership, legal, financial, and high-level corporate environments where credibility matters.

Absolutely. Tailored pantsuits are fully accepted and widely preferred in modern business formal settings.

Minimal patterns are acceptable, but solid colors are safest and most professional.

Black is appropriate, especially in formal or executive settings, though navy and charcoal are often more versatile.

BUSINESS

Business Personal Property Insurance: The Complete, Real-World Guide for Business Owners

Introduction

Picture this for a moment. You unlock your business one morning, coffee in hand, already mentally running through the day’s to-do list. But something’s wrong. The door looks forced. Inside, the laptop you use for invoicing is gone. The POS system is missing. Shelves are half empty. In a few minutes, you realize the loss isn’t just emotional—it’s financial, operational, and potentially business-ending.

This is exactly where business personal property insurance steps in.

Most business owners spend plenty of time thinking about customers, marketing, payroll, and growth. Insurance often sits quietly in the background—until the day it suddenly becomes the most important document you own. Business personal property insurance protects the physical items your business relies on every single day, from computers and furniture to inventory and specialized equipment.

In this guide, we’re going deep. Not surface-level explanations or policy jargon copied from an insurer’s brochure, but a practical. Human explanation of how business personal property insurance really works in the real world. You’ll learn what it covers, what it doesn’t, how to choose the right limits. Common mistakes to avoid, and how to make sure you’re not underinsured when it matters most.

Whether you run a small home-based operation. A retail store, a growing agency, or a multi-location business, this article will give you the clarity and confidence to make smarter insurance decisions.

What Is Business Personal Property Insurance?

At its core, business personal property insurance covers the physical, movable items your business owns and uses to operate. Think of it as insurance for the “stuff” that makes your business functional.

A simple analogy helps here. If your building is the skeleton of your business .Business personal property is the muscle. Organs, and nervous system. Without it, the structure might still stand, but nothing works.

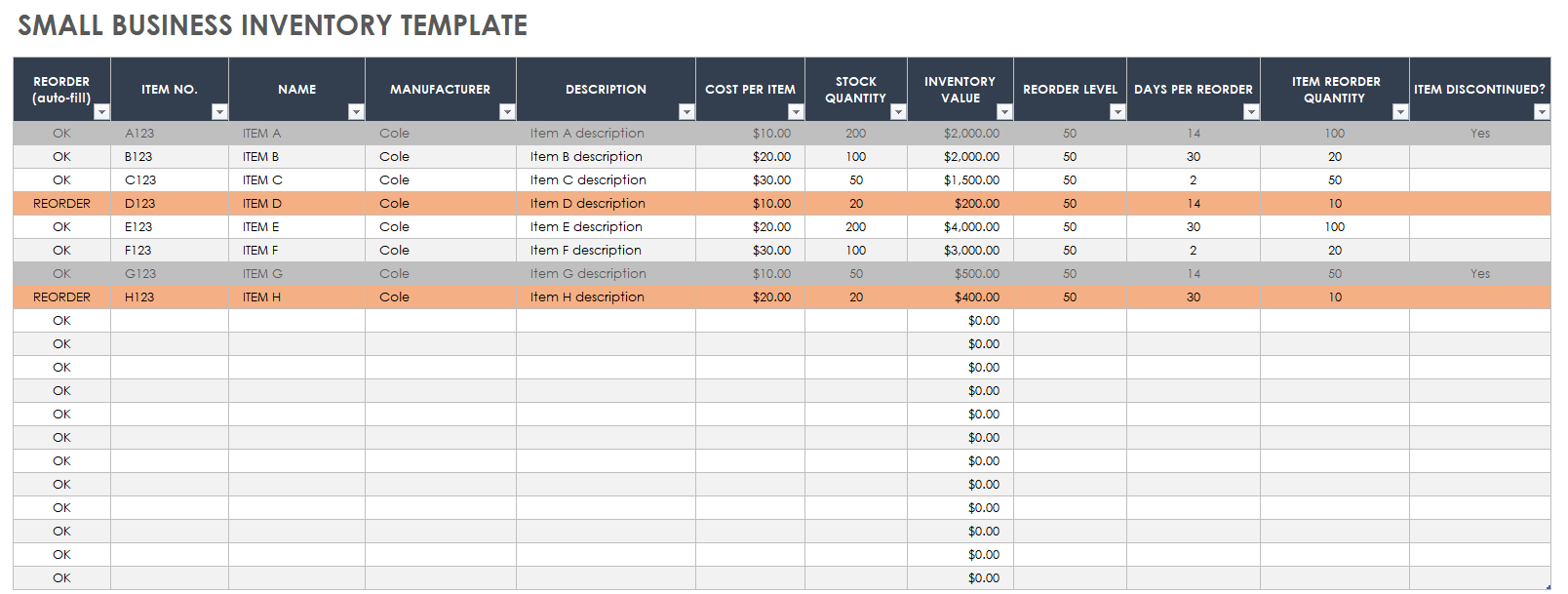

Business personal property typically includes:

- Office furniture (desks, chairs, shelving)

- Computers, servers, and electronics

- Tools and machinery

- Inventory and stock

- Fixtures you’ve installed but don’t permanently own

- Supplies and equipment used for daily operations

It’s usually bundled into a commercial property policy or a Business Owner’s Policy (BOP). But it can also exist as a standalone coverage depending on your setup.

One key point that confuses many people: business personal property is not the same as personal property under a homeowner’s policy. If you’re running a business from home. Your personal insurance likely offers very limited protection for business items—often capped at a low dollar amount. Business personal property insurance fills that gap.

Another important distinction is ownership and responsibility. The coverage applies to items you own, lease. Or are legally responsible for, even if they’re not physically located inside a building you own.

In short, business personal property insurance ensures that if disaster strikes—fire, theft, vandalism. Or certain weather events—you can replace what you need to keep operating, not just stare at an empty space and a pile of receipts.

Why Business Personal Property Insurance Matters More Than You Think

Many business owners underestimate how much their physical assets are worth until they’re forced to list them out. One laptop here, a printer there, shelves, signage, inventory—it adds up fast.

Let’s take a realistic example. A small digital agency with:

- 5 laptops at $1,500 each

- Office furniture worth $6,000

- Networking equipment worth $3,000

- Cameras and production gear worth $10,000

That’s over $26,000 in business personal property, and that’s before you factor in software-dependent hardware. Backup systems, or specialized tools. Now imagine replacing all of it out of pocket after a fire or break-in.

This insurance matters because:

- It protects your cash flow after a loss

- It shortens downtime after a disaster

- It can mean the difference between reopening or closing permanently

- It helps you meet lease or lender requirements

- It provides peace of mind so you can focus on growth

According to industry data, a significant percentage of small businesses that experience a major uninsured loss never reopen. It’s not the loss itself that kills the business—it’s the inability to recover quickly.

Business personal property insurance isn’t about worst-case paranoia. It’s about acknowledging that accidents, crime, and natural events don’t care how hard you’ve worked to build your business.

What Does Business Personal Property Insurance Cover?

Coverage details vary by policy, but most business personal property insurance includes protection against a defined list of “covered perils.” Understanding these is crucial.

Commonly covered events include:

- Fire and smoke damage

- Theft and burglary

- Vandalism

- Windstorms and hail (depending on location)

- Certain types of water damage (like burst pipes)

- Explosions

- Lightning damage

Covered property usually includes:

- Furniture and fixtures

- Machinery and tools

- Inventory and stock

- Computers and electronics

- Tenant improvements you paid for

- Property temporarily off-site (limited coverage)

Coverage is typically written on either a named perils basis (only listed events are covered) or special form (everything is covered unless specifically excluded). Special form coverage is broader and often worth the slightly higher cost.

It’s also important to understand valuation:

- Actual Cash Value (ACV): Replacement cost minus depreciation

- Replacement Cost Value (RCV): Cost to replace with new items of similar quality

Most seasoned business owners opt for replacement cost coverage, because depreciated payouts often fall far short of what you actually need to replace essential equipment.

What Business Personal Property Insurance Does Not Cover

Knowing exclusions is just as important as knowing coverage.

Common exclusions include:

- Flood damage (requires separate flood insurance)

- Earthquakes (requires separate endorsement or policy)

- Wear and tear or mechanical breakdown

- Employee theft (covered under crime insurance)

- Cyber incidents or data loss

- Vehicles (covered under commercial auto insurance)

- Property in transit (may require inland marine coverage)

This is where many claims disputes come from. A business owner assumes “insurance is insurance,” only to discover that a specific type of loss falls outside their policy’s scope.

For example, if your inventory is damaged due to a sewer backup, coverage may depend on whether you added a water backup endorsement. If your laptop is stolen from your car, coverage might be limited or excluded unless you have off-premises protection.

The fix is simple but often skipped: read the exclusions and endorsements carefully, or review them with an agent who explains them in plain English.

Who Needs Business Personal Property Insurance?

Short answer: almost every business that owns physical assets.

This includes:

- Retail stores with inventory and fixtures

- Restaurants with kitchen equipment

- Offices with electronics and furniture

- Contractors with tools and equipment

- Home-based businesses with professional gear

- E-commerce sellers storing inventory

- Creative professionals with cameras or studios

Even service-based businesses with “minimal” equipment often underestimate their exposure. A consultant may rely on a laptop, external drives, phone systems, and monitors—all critical to daily operations.

If your business would struggle to operate without replacing physical items, business personal property insurance isn’t optional—it’s foundational.

How Business Personal Property Insurance Works Step by Step

Understanding the process helps remove the intimidation factor.

Steps

1: Inventory your property

Start by listing everything your business owns. Walk through your space, room by room. Include quantities, approximate values, and replacement costs.

2: Determine replacement value

Ask yourself: what would it cost to buy this new today? Don’t rely on what you paid years ago.

3: Choose coverage limits

Your policy limit should reflect the total replacement cost, not a rough guess.

4: Select valuation method

Choose replacement cost over actual cash value whenever possible.

5: Add endorsements if needed

Consider off-premises coverage, higher limits for electronics, or coverage for property in transit.

6: Pay your premium

Premiums are typically affordable compared to the risk—often a few hundred dollars per year for small businesses.

7: File a claim if loss occurs

Document damage, notify your insurer promptly, and keep records of repairs or replacements.

8: Recover and rebuild

Once approved, funds are paid to help you replace property and resume operations.

The smoother this process is depends largely on how well you prepared before the loss.

Choosing the Right Coverage Limits

Underinsuring is one of the most common mistakes business owners make. They choose a low limit to save money, not realizing that partial coverage often leads to partial recovery.

Here’s a practical approach:

- Use replacement cost, not purchase price

- Include future growth buffer

- Account for seasonal inventory spikes

- Revisit limits annually

If your policy has a coinsurance clause and you’re underinsured, your claim payout may be reduced—even if the loss is smaller than your total limit. This surprises many first-time claimants.

A slightly higher limit usually costs far less than you expect and provides significantly better protection.

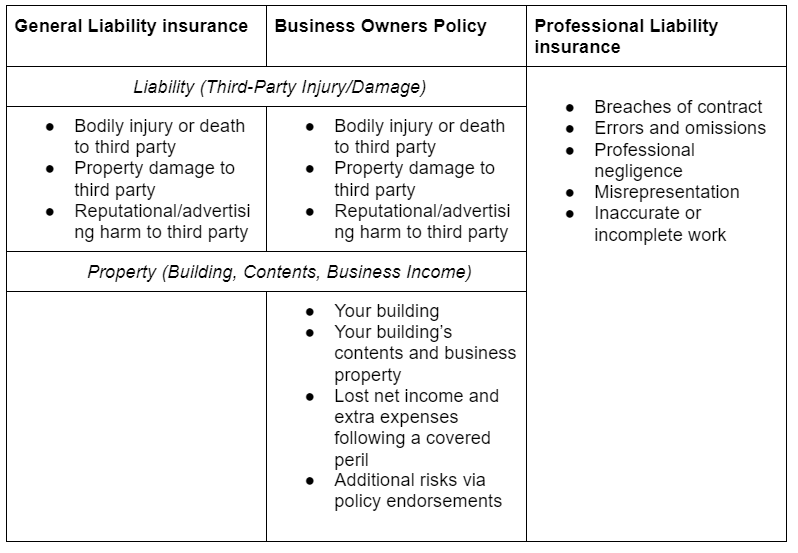

Business Personal Property Insurance vs Other Coverages

4

It helps to see how this coverage fits into the bigger picture.

Business personal property insurance:

- Covers physical items you own

- Protects against specific perils

- Focuses on replacement or repair

Commercial liability insurance:

- Covers injuries or damage to others

- Does not cover your own property

Inland marine insurance:

- Covers property in transit or off-site

- Ideal for contractors or mobile businesses

Commercial auto insurance:

- Covers vehicles and attached equipment

- Not covered under property policies

Cyber insurance:

- Covers data breaches and cyber losses

- Separate from physical property protection

Think of business personal property insurance as one piece of a well-rounded risk management puzzle.

Common Mistakes Business Owners Make (And How to Fix Them)

1: Assuming homeowner’s insurance is enough

Fix: Get a business-specific policy or endorsement.

2: Guessing coverage limits

Fix: Perform a detailed inventory and valuation.

3: Choosing actual cash value

Fix: Opt for replacement cost coverage.

4: Ignoring exclusions

Fix: Review policy details and add endorsements where needed.

5: Not updating coverage as you grow

Fix: Review annually or after major purchases.

6: Poor documentation

Fix: Keep receipts, photos, and serial numbers.

Avoiding these mistakes turns insurance from a checkbox into a true safety net.

Real-World Scenarios Where Business Personal Property Insurance Saves the Day

Scenario 1: Retail theft overnight

Inventory and POS systems are stolen. Coverage replaces equipment and stock within weeks.

Scenario 2: Office fire

Smoke and water damage destroy electronics and furniture. Replacement cost coverage allows a quick return to work.

Scenario 3: Burst pipe

Water damages inventory and fixtures. Endorsed water damage coverage covers repairs and replacements.

These aren’t rare events. They’re common stories from claims adjusters every day.

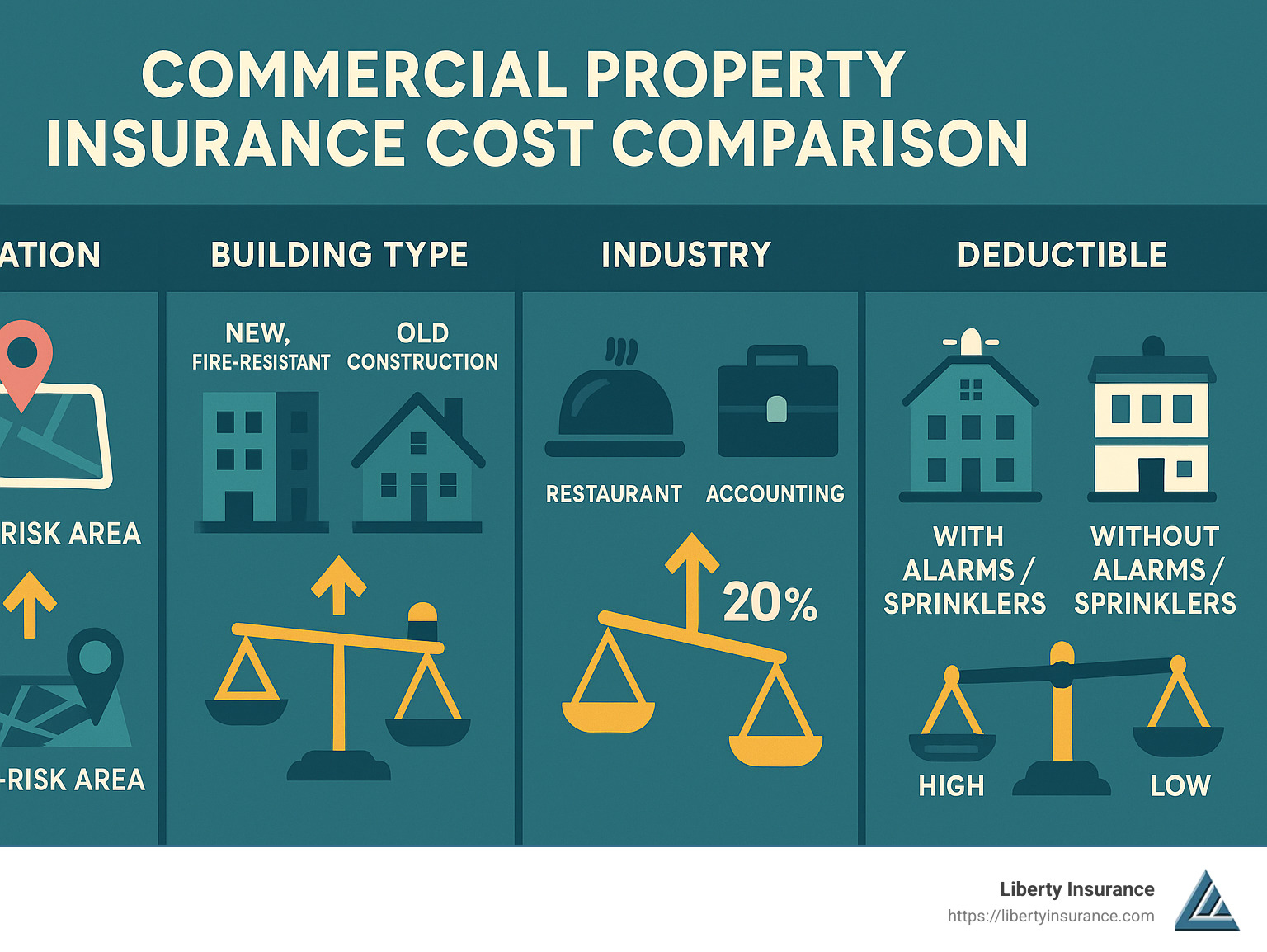

How Much Does Business Personal Property Insurance Cost?

Costs vary based on:

- Business type

- Location

- Total insured value

- Coverage form

- Deductible amount

For many small businesses, costs range from:

- $300 to $1,200 per year as part of a BOP

- More for high-risk or equipment-heavy industries

The return on investment is massive compared to the potential loss.

How to File a Successful Claim

Preparation matters more than luck.

Best practices:

- Notify your insurer immediately

- Document damage with photos and video

- Create a detailed loss inventory

- Keep damaged items until advised otherwise

- Maintain open communication

A well-documented claim moves faster and results in fewer disputes.

Conclusion

Business personal property insurance isn’t flashy. It won’t drive traffic or boost sales. But when something goes wrong—and eventually, something always does—it can be the single reason your business survives.

By understanding what it covers, choosing the right limits, avoiding common mistakes, and reviewing your policy regularly, you turn insurance from a boring expense into a powerful business continuity tool.

If you’ve ever thought, “I’ll deal with insurance later,” now is the right time to revisit that mindset. Your future self—and your business—will thank you.

FAQs

It covers physical items your business owns, such as equipment, furniture, and inventory, against covered losses.

Not usually, but landlords and lenders often require it.

Limited off-premises coverage may apply; additional coverage is often needed.

Yes, inventory is typically included, but limits and exclusions apply.

No, that requires a separate crime insurance policy.

BUSINESS

High Paying Side Jobs for Students USA That Actually Pay Well in 2026

Introduction

If you’re a student in the United States, you’ve probably felt the financial squeeze at some point—tuition bills, rent, textbooks, groceries, and the constant pressure to “gain experience” before graduation. I’ve been there. I remember juggling classes with a part-time job that barely covered coffee and gas, wondering how some students seemed to earn real money while still keeping their grades intact. That curiosity led me to explore high paying side jobs for students USA, and what I discovered changed how I thought about student work entirely.

Here’s the truth: student jobs are no longer limited to minimum-wage shifts or exhausting overnight roles. Today, thanks to remote work, the gig economy, and skill-based platforms, students can earn $20, $30, even $50+ per hour—often on flexible schedules that fit around classes. This guide is designed to show you exactly how to do that, without hype or unrealistic promises.

In this in-depth article, you’ll learn what high paying side jobs actually mean in the U.S. student context, which opportunities pay the most, how to get started step by step, the best tools to use, and the mistakes that silently keep students underpaid. Whether you’re an international student with work restrictions, a full-time undergrad, or a grad student trying to minimize loans, this guide will help you make smarter income choices.

Understanding High Paying Side Jobs for Students in the USA

When people hear “high paying side jobs,” they often imagine something shady or unattainable. In reality, a high paying side job for students simply means work that offers above-average hourly or project-based income, without requiring a full-time commitment or a completed degree. In the U.S., this usually translates to roles that pay more than $20 per hour or $500+ per project, depending on the skill and time involved.

Think of it this way: traditional student jobs pay you for time. High paying side jobs pay you for value. If you can write well, design graphics, tutor effectively, manage ads, edit videos, or build simple websites, the market rewards you based on outcomes—not hours clocked.

Another important distinction is flexibility. A true student-friendly side job allows you to:

- Choose your working hours

- Scale up or down during exams

- Work remotely or on short-term projects

The U.S. market is especially favorable because businesses are used to hiring freelancers, contractors, and student workers. Platforms, startups, and even local businesses actively look for students who are hungry, adaptable, and tech-savvy. That’s why the best high paying side jobs for students in the USA often live at the intersection of digital skills, problem-solving, and convenience.

Why High Paying Side Jobs Matter (Benefits & Use Cases)

The biggest benefit of landing a high paying side job as a student isn’t just the money—it’s leverage. When you earn more per hour, you buy back time. Time to study, sleep, network, and actually enjoy college life. I’ve seen students replace 25-hour minimum-wage schedules with 8–10 hours of freelance work and still earn more overall.

Here’s how these jobs show up in real life:

A computer science student tutors Python online and earns $40/hour, working just weekends. A marketing major manages Instagram accounts for two local businesses and clears $1,200/month. A journalism student writes SEO blog posts and builds a portfolio that lands them a job before graduation. These aren’t exceptions—they’re common scenarios when students choose strategically.

High paying side jobs for students in the USA are especially useful if you:

- Want to reduce student loan dependence

- Need flexible income due to a heavy course load

- Want resume-worthy experience before graduating

- Are an international student limited to certain work hours

Beyond income, these jobs often double as career accelerators. You’re not just earning—you’re building proof of skills, professional references, and sometimes even future employers. That combination of money + momentum is what makes high paying student side jobs so powerful.

Top High Paying Side Jobs for Students in the USA

Freelance Writing & Content Creation

Freelance writing is one of the most accessible high paying side jobs for students in the USA, especially for those who already enjoy research and storytelling. Businesses constantly need blog posts, website copy, email newsletters, and product descriptions. Entry-level writers often start at $0.05–$0.10 per word, but skilled students quickly move into $0.20+ territory.

The key is specialization. A student who writes about tech, health, finance, or SaaS will earn more than a generalist. Many students find work through platforms like Upwork or by pitching blogs directly.

What makes this job student-friendly is flexibility. You can write between classes, batch work on weekends, and scale up during breaks. Over time, writing becomes a compounding skill—each project makes the next one easier and better paid.

Online Tutoring (Academic & Test Prep)

If you’re strong in a subject like math, chemistry, economics, or SAT/ACT prep, online tutoring can pay exceptionally well. Many students earn $25–$60 per hour tutoring peers or high school students.

Unlike traditional tutoring centers, online platforms let you set availability and often work from your dorm room. Parents are willing to pay premium rates for results, especially in STEM subjects. This is one of the few side jobs where being a current student actually increases your credibility.

Graphic Design & UI/UX Gigs

Design-oriented students can monetize their skills quickly. Logo design, social media graphics, pitch decks, and website layouts are in constant demand. Even beginner designers can earn $30–$50 per project, while experienced ones charge several hundred.

Platforms like Fiverr allow you to package services clearly, which helps students attract clients without cold outreach. The more niche your offering (for example, “Instagram Reels covers for coaches”), the higher your earning potential.

Video Editing & Short-Form Content

With TikTok, YouTube Shorts, and Instagram Reels dominating marketing, video editors are in demand. Students who know Premiere Pro, Final Cut, or even CapCut can charge $25–$75 per hour.

This side job works well for students because projects are discrete. You edit a video, deliver it, and move on. Many clients offer ongoing weekly work, creating predictable income without a rigid schedule.

Virtual Assistant & Automation Roles

Virtual assistants handle tasks like email management, CRM updates, research, and scheduling. Students who are organized and tech-comfortable can earn $20–$35 per hour, especially when working with entrepreneurs or startups.

Those who learn tools like Notion, Zapier, or Airtable can command higher rates by offering automation—not just admin help. This is a great option for business, management, or IT students.

Tech & Coding Side Jobs

If you can code—even at a basic level—you’re in a strong position. Simple website builds, bug fixes, and no-code projects using Webflow or WordPress often pay hundreds per job.

Computer science students often underestimate how marketable their early skills are. You don’t need to build the next Facebook; you just need to solve small problems reliably.

Step-by-Step Guide to Landing a High Paying Student Side Job

Step 1: Identify a Monetizable Skill

Start by listing what you already know or can learn quickly. Writing, tutoring, design, editing, research, data entry, or social media management are all viable. The goal is not perfection—it’s usefulness.

Ask yourself: “What problem can I solve for someone else right now?” That answer is your starting point.

Step 2: Choose the Right Platform or Channel

Different jobs live in different places. Freelancing platforms, campus job boards, LinkedIn, and even local Facebook groups can all be effective. The trick is focus. Pick one or two channels and commit for 30 days.

Step 3: Build a Simple Proof of Skill

You don’t need a fancy website. A Google Doc portfolio, a few sample projects, or mock work is enough. Clients care more about outcomes than credentials.

Step 4: Price for Value, Not Desperation

Many students underprice themselves out of fear. Instead, research average rates and start in the middle. You can always adjust, but starting too low makes it harder to raise prices later.

Step 5: Deliver Exceptionally and Upsell

Your first few clients are everything. Overdeliver slightly, communicate clearly, and ask for testimonials. That social proof unlocks higher-paying opportunities faster than anything else.

Tools, Platforms & Smart Recommendations

The right tools can dramatically increase your earning efficiency. For freelancing, platforms like Upwork and Fiverr are popular starting points, but they’re competitive. The upside is built-in clients; the downside is platform fees.

Free tools like Google Docs, Canva, and Notion are often enough to get started. Paid tools—Adobe Creative Cloud, Grammarly Premium, or specialized tutoring software—make sense only once you’re earning consistently.

A smart approach is to:

- Start free

- Upgrade only when the tool saves time or increases income

- Avoid subscriptions you don’t actively use

For local or delivery-based side jobs, companies like DoorDash can work short-term, but they rarely qualify as “high paying” long-term due to wear-and-tear costs. Skill-based work almost always wins in the long run.

Common Mistakes Students Make (and How to Fix Them)

One of the biggest mistakes is chasing “easy money.” High paying side jobs require some upfront effort—learning, pitching, or practicing. Students who quit after a week often miss the payoff curve.

Another common error is undervaluing time. Working 30 hours a week for low pay leaves you exhausted and academically stretched. The fix is simple: prioritize roles with higher hourly value, even if they require learning something new.

Poor communication is another silent killer. Missed deadlines, unclear messages, and slow responses cost students repeat work. Treat your side job like a micro-business, not a hobby.

Finally, many students never reinvest in themselves. Spending a small amount on a course or tool that upgrades your skill can double your income within months. That’s not an expense—it’s leverage.

Conclusion

High paying side jobs for students in the USA are not myths or rare unicorns. They’re practical, attainable opportunities hiding in plain sight—often just one skill upgrade or mindset shift away. The students who succeed aren’t necessarily smarter or more connected; they’re more intentional about how they trade time for money.

If you take one thing away from this guide, let it be this: aim for value, not volume. Choose work that pays you for what you know and how well you solve problems, not how many hours you can stay awake. Start small, stay consistent, and let your skills compound. If you do, your bank account—and your future résumé—will thank you.

FAQs

Freelance writing, tutoring, coding, video editing, and digital marketing consistently top the list due to high demand and scalable pay.

Yes, but they must follow visa rules. On-campus jobs and CPT/OPT-approved roles are safest options.

Many students earn $500–$2,000/month part-time. Skilled freelancers often exceed that during breaks.

Basic skills and samples are enough. Experience grows quickly once you land your first client.

Online jobs usually pay more and offer flexibility, while local jobs may provide faster cash flow.

-

BLOG7 months ago

BLOG7 months agoDiscovering The Calamariere: A Hidden Gem Of Coastal Cuisine

-

TECHNOLOGY4 months ago

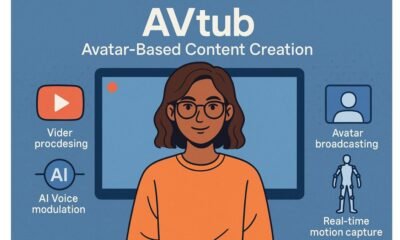

TECHNOLOGY4 months agoAVtub: The Rise of Avatar-Driven Content in the Digital Age

-

HEALTH8 months ago

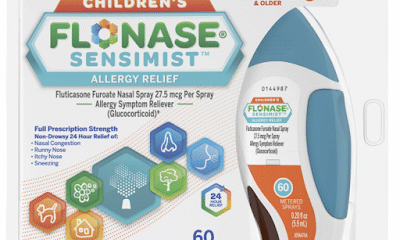

HEALTH8 months agoChildren’s Flonase Sensimist Allergy Relief: Review

-

BLOG8 months ago

BLOG8 months agoWarmables Keep Your Lunch Warm ~ Lunch Box Kit Review {Back To School Guide}

-

HEALTH8 months ago

HEALTH8 months agoTurkey Neck Fixes That Don’t Need Surgery

-

TECHNOLOGY7 months ago

TECHNOLOGY7 months agoHow to Build a Mobile App with Garage2Global: From Idea to Launch in 2025

-

EDUCATION4 months ago

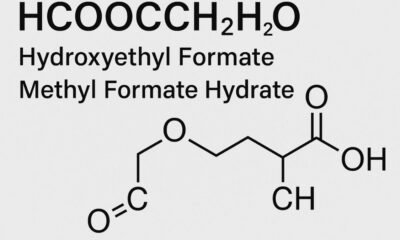

EDUCATION4 months agoHCOOCH CH2 H2O: Structure, Properties, Applications, and Safety of Hydroxyethyl Formate

-

HEALTH8 months ago

HEALTH8 months agoMasago: The Tiny Sushi Topping with Big Health Benefits